Inventory is “Strange” in Charleston

Homes for sale inventory across the Charleston area is down 24% from January of last year and prices are down only slightly. This is “strange” because you might expect lower inventory to move prices more dramatically. NAR says December ended with a 6.2 month supply of homes nationwide (how many months it would take to sell all inventory at December’s sales rate) and that figure is near a multi-year low. Usually, you’d expect prices to go up if sales volume is steady and supply makes a significant drop.

What’s happening? We think several factors are damping demand and holding prices in check. In no particular order:

- According to the Mortgage Banker’s Association sellers are more pessimistic than they’ve ever been: only 7% of sellers feel optimistic about their prospects in the market. As a result, sellers are putting off listing their homes. This behavior drives down inventory, but has another less obvious effect. Sellers often become buyers, so less selling means fewer buyers in the market looking to move-up or downsize.

- Banks are still cautious with their lending. 38% of home purchases in 2011 were with cash versus a normal 18-19%. Many of the cash buyers are investors who see a great deal and plan to rent or flip the homes, but a large number of 2011 cash buyers probably would have gotten loans in past years. We believe there are buyers on the sidelines because they can’t get loans or don’t think they can get loans.

- In many markets the limited inventory isn’t very attractive to buyers. The low inventory has many problems that make the homes available unattractive to many buyers: short sales, unrealistic prices, and homes that nobody wants. We hear from agents in a wide-range of markets that turn-key, ready-to-move-in properties are getting multiple offers and end up going over asking price. We think there is a group of buyers with the capacity to purchase who are just waiting for their dream house to come on the market.

1. People are refinancing instead of selling.

Assuming your property value is above your loan balance, refinancing at 2011 interest rates saved South Carolina homeowners a small fortune. Let’s say you have a $200,000 mortgage rate at a 7% interest rate. That means your mortgage payment is about $1330/month. If you refinance to the current low rate of 3.96%, your mortgage rate falls to about $950/month. That’s almost $6000/year in savings—you can finally afford those granite counter tops you’ve always wanted.

More support from big wigs.

It looks like President Obama is also trying to perpetuate the refinancing extravaganza. In his recent State of the Union address, the President proposed letting underwater mortgage holders (meaning they owe more than their home is worth) who are current on their payments refinance their mortgages with government approval. It’s not a given that Congress will go along with this plan, but if it passes, it would keep even more owners in their homes.

2. Urgency to sell now reduced.

Foreclosures are down 11.9% across the state of South Carolina, relative to the same time period a year prior. Excellent news, not just for the economy, but for my own delicate sensibilities whenever I read about foreclosure hardships in the news. Even Paul Krugman of the New York Times sees the economy improving. The magical flow chart of economic success is revving up, and that eventually means:

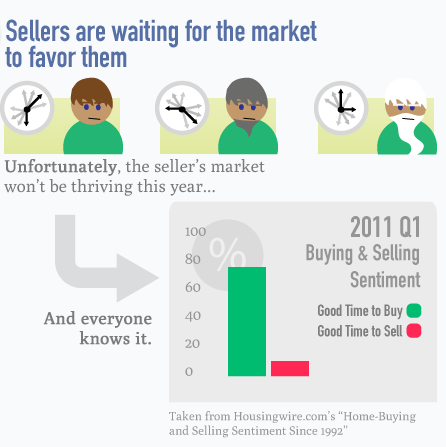

3. Sellers are waiting for the market to favor them.

It may be hard for sellers to hear, but it’s likely that the seller’s market won’t be thriving this year, as prices should continue to remain relatively flat (i.e. prices haven’t changed much and are not expected to). Also, the current homes on the market all across South Carolina are slightly bigger than last year at a price point of about 4% less than last year. This reduces the price per square footage 5-8% across the state, compared to the same time period last year. Not quite the upswing that sellers have been waiting for.

Move-up buyers are out of the market.

Move up buyers make up the core of a healthy, strong housing market. They’re the ones buying bigger, better digs, which free up the smaller starter homes for first-time buyers. The recession has kept them stationary, and for that reason a good chunk of the best part of the market isn’t looking to buy.

4. Buyers don’t like the merchandise.

In a market with a smaller inventory, you would expect prices to rise (the laws of supply and demand usually dictate that as supply shrinks, price rises). That means that the real problem may lie on the demand side. Prospective homebuyers are either shunning what’s currently on the market (foreclosures, short sales, or maybe just some really ugly houses), or the overall economic forecast scares potential buyers out of the market. My bet is that it’s a bit of both.

As further proof of potentially “bad” inventory, current sellers have dire motives.

It almost feels like those brave sellers out there are doing it because they absolutely have to. What’s the logic behind that conclusion? Well, generally, you can get a sense of how sellers behave in a market by asking them over and over and looking at the results over time. That’s what the guys at Housingwire.com did, and you can see that only ~8% of people think that it’s a good time to sell. So, likely many sellers are obliged to sell for some reason or another (*cough*too many babies*cough*) and as a result, buyers aren’t loving what they see on the market.

5. Tight credit limits the number of potential buyers.

If you’re living in, say, Detroit, cash deals may not seem out of the ordinary. For Charlestonians cash deals don’t seem possible unless you’re Scrooge McDuck with a swimming pool filled with money…or Mark Zuckerburg making his face public. In a normal market, 18-20% of all home transactions are paid in cash; right now, a whopping 38% of home transactions are cash deals. Cash buyers (typically investors) are more of a “sure thing” than buyers who finance, which means that they are swooping up inventory while pre-qualified buyers pause to deal with various financing woes. The result is that there is less inventory available, while prices stay static.

Hopefully, this gives you a better understanding of Charleston’s buying forecast (partly cloudy?) and the possible explanation behind such a dearth of inventory on the market. If you’re selling, I wish you the best of luck, truly. Happy House Hunting!